Since the earliest days of the United States, tax policy at the federal level has encouraged the development of promising industries and public works. Canals and harbors were early projects completed for the public good and assisted with tax policy. The cross-continental railroad became a reality sooner because of tax credits. The aluminum industry got the boost it needed through federal tax credits, just in time for the war effort in the 1940s, where this lightweight metal played a key role in developing modern aircraft. Tax policy helped nurture the semiconductor industry in the 1980s as well.

Today the federal government continues to help necessary and needed industries gain a foothold and prosper. The U.S. solar industry continues this tradition of wise policy and practical results. Homeowners across the United States that go solar or go solar and add a battery system now receive a 30% tax credit against their renewable project costs.

Officially called the “Residential Clean Energy Credit” and commonly known as the Solar Tax Credit, this is designed to speed up solar adoption. With over 5 million homes in the United States already solar powered, it is clear that this policy works.

Let’s dive into the details a bit more:

- The project must be located in the United States, and Pennsylvania residents must meet this first requirement.

- Project costs include labor and materials, as well as design and engineering work. Basically, the amount you pay the solar company for the installation and related costs like permitting all qualify.

- If the project is completed in 2024, then the tax credit is for your 2024 filing.

- There is no project cap for this credit. Whether your solar project costs $10,000 or $100,000, you are still eligible for the 30% tax credit.

- Important to note: this is a CREDIT and not a deduction. If you owe the IRS $10,000 for the year and you have a solar project tax credit for $9,000 then you are writing a check for only $1,000. In that same example, if you owed the IRS nothing and had that tax credit, the IRS would be sending you a check for $9,000.

While this residential energy credit can save a lot of money in taxes, you must make a proper claim using IRS Form 5695 to receive that money. We will explain later, step by step, how to make this claim. While IRS forms can be easily filled out by most taxpayers, you will be pleasantly surprised to see that your favorite online tax software companies are ready to add your solar tax credit with just a few questions.

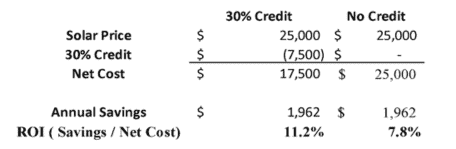

As we pointed out, this 30% tax credit is about getting people to make the investments that our country needs. For a typical solar system, taking 30% off the price makes for some fairly compelling economics. For example:

By the way, annual returns over 10% are common in our area with good producing solar systems. In the example above we also included the local state incentive available for solar homeowners. You get both the federal and state incentives.

Also important to note that even WITHOUT the tax credit, solar energy still delivers an impressive savings and return each year. That was the idea from the beginning: help get solar to a point where its innate efficiency becomes the obvious choice.

All good things come to an end. The same is true for the solar tax credit however you have until January 1st 2033 before this credit expires.

Claiming Your Tax Credit

If you’re wondering, “How do I fill out Form 5695 to claim the Solar Tax Credit?” then this article is for you. With these step-by-step Form 5695 instructions, you can better understand the process for receiving the credit you deserve.

What is IRS Form 5695?

Form 5695 is the document you submit to get a credit on your tax return for installing solar panels on your home. We commonly think of Tax Form 5695 as the Residential Clean Energy Credit Form.

You can request a copy of Form 5695 from the Internal Revenue Service (IRS) Website and also review the Form 5695 Instructions.

The document itself discusses a concept called “Residential Energy Credits” which is the specific term used by the IRS to calculate non-refundable credit for a residential energy-efficient property. However, only qualified residential energy-efficient improvements in the United States are eligible for the credits. This includes renovations such as residential solar panel systems, solar energy storage, fuel cells, geothermal heat pumps, and small wind turbines.

What is the Solar Energy Tax Credit?

The Solar Tax Credit is a federal tax credit for solar systems you can claim on your income taxes that reduce your federal tax liability. The tax credit is calculated based on a percentage (30% ) of the total cost of your solar energy system.

This federal residential solar energy credit makes solar energy more affordable by giving a dollar-for-dollar tax reduction. Your solar energy system must have started service during the current tax year to qualify for the credit and need IRS Form 5695.

Since these tax credits are not deductions, they generally reduce the amount of tax the claimant owes, which can create a tax refund. The tax credit is also not a “discount,” as taxpayers still have to bear the cost of the improvements and then claim the credit from the IRS when filing their tax returns. Taxpayers can claim these credits on IRS Form 5695 regardless of whether or not they itemize deductions on Schedule A.

Disclaimer: Butterfly PBC believes the information contained here is accurate. However, we are not tax preparation experts. We recommend that you seek out the advice of a licensed accountant or tax professional if you have any specific questions about filling out Form 5695 to claim the Residential Clean Energy Credit.

How to Fill Out IRS Form 5695

Step 1 – Calculate Total Cost Of Your Solar Power System

The total system costs of the solar power system for your home is the gross (total) amount you spent on it from your solar company, minus any other cash rebates you received, including state tax credits, incentives, and rebates. Add this number to line 1.

Step 2 – Add Additional Energy-Efficient Improvements

Fill in the total cost of any other energy-efficient improvements you might have made on lines 2 through 4. These additional improvements can include home solar water heating, small wind energy generators, geothermal heat pump property costs, and more. Add these up for line 5.

Step 3 – Calculate Tax Credit Value

Calculate the federal solar tax credit you qualify for by multiplying the number from line 5 by 30%. Place the answer on line 6.

Step 4 – Enter Your Tax Credit Value

Enter the value from line 6 on line 13 if you are not receiving a tax credit for fuel cells and don’t have any tax credits to carry forward from the previous year.

Step 5 – Calculate Your Tax Liability

Calculate if you have sufficient tax liability from your taxable income to get the full 30% tax credit available in one year.

Step 6 – Calculate Maximum Tax Credit You Can Claim

Calculate the maximum tax credit you can claim by turning to page 4 and completing the instructions for that worksheet. You will need to include any information about any other tax credits for which you qualify, including buying an electric vehicle, being a first-time homeowner, or interest on your mortgage.

Step 7 – Enter Your Maximum Tax Credit

Enter the result of line 6 (the limit of the tax credits you can claim) to line 14.

Compare the values of lines 13 and 14 and put the smaller of the two on line 15 of the form.

Step 8 – Calculate Any Carry-Over Credit

Compare your tax liability from Step 5 with your tax credits. If your tax liability is smaller, calculate the amount you can claim on next year’s taxes by subtracting the value on line 15 from line 13. Enter the result on line 16.

Step 9 – Enter Your Credit on Form 1040

The value you filled on line 15 is the amount the IRS will credit on your taxes this year. Enter this number on line 5 of Schedule 3 on Form 1040.

If you make additional energy-efficient home improvements in the fiscal year, you may qualify for other tax credits. If so, you will need to complete the second page of Form 5695.